Chapter 7 vs 13 and what factors to consider:

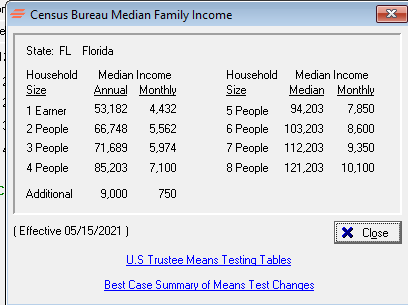

Means Test: Household Income & Size

When Debtors have income higher than Median, then a “long form” is needed. The Long Form Means Test considers types of debt, pay deductions, living expenses and other necessary living expenses. Any special circumstances to support that a Chapter 7 filing is still appropriate are disclosed at the end. If Debtor cannot pass Means Test their only bankruptcy option is Chapter 13.

Special Circumstances that might make Chapter 13 Preferable even if Means Test is passed:

Domestic Support Arrearage/Collections

11 USC 523(a)(5) makes Child Support and Alimony arrearages non dischargable in Chapter 7, but they can be paid back over time in a Chapter 13 Plan. This will stop DOR Enforcement like contempt hearings and suspension of licenses.

Debt Owed to Ex Spouse Ordered in Family Law Final Judgment

11 USC 523(a)(15) makes any debt “to a spouse, former spouse, or child of the debtor not described in (a)(5) that is incurred by the debtor in the course of a divorce or separation agreement, divorce decree or other order of a court of record, or a determination made in accordance with State or territorial law by a governmental unit…” non dischargable in Chapter 7, but it can be with a completed Plan and discharge in a Chapter 13… and it does not have to be paid in full like child support or alimony.

Recent Taxes

Generally any taxes that came due within the last three years before filing are not dischargable, but can be paid across a Chapter 13 Plan. Doing this stops collection efforts like garnishments and liens during the Chapter 13 Plan. (It is strongly recommended that a debtor’s tax history be reviewed by a specialist regarding timing and dischargability before filing any kind of bankruptcy case)

Other Priority Collections

11 USC 507 has a big list but the main ones are usually: Wages owed to employees, Contributions owed to employee’s retirement accounts and amounts owed as a result of death or personal injury caused by DUI.

Liquidity

When the value of assets the debtor wants to keep exceed exemptions, but debtor can’t easily buy it back from a Chapter 7 Bankruptcy Estate. Best examples would be a newer lien-free vehicle or non-homestead real estate.

Student Loan Collections

Student Loans are not discharged under any chapter of bankruptcy without serious uphill battle litigation that is rarely successful. Like Domestic Support Arrearages, though, they can be managed for a few years in a Chapter 13 Plan.

Foreclosure Avoidance

Chapter 13’s are often used to stop a homestead foreclosure and buy time to try to save the home. It must be done with a good faith intention while applying for Mortgage Modification Mediation or when the arrearage on the mortgage is low enough to be repaid over the life of a Plan.

Significant Preferential Transfers (11 USC 547/548)

11 USC 547 allows a trustee to recapture any repayments of debt to friends or family made within the year before the bankruptcy is filed. Often this is when a debtor pays back their parent or best friend with a tax refund or a disability lump sum. The options for the debtor are: pay it to the estate OR give the information of the person who received the payment to the Trustee and the Trustee will go sue them in bankruptcy court. Most often the debtor does not want their parent or best friend to be sued, so they agree to pay it to the estate. Sometimes that amount is too much to manage in a Chapter 7, but can be spread out across a Chapter 13 Plan.

Similarly, 11 USC 548 covers fraudulent transfers or any transfers made without consideration in the two years before filing (FL law allows a Trustee to go back four years from filing).

It is important to remember that Chapter 13 will only work with regular consistent ongoing income.

Information/Items needed to evaluate the client’s circumstances

The minimum paperwork needed to properly evaluate a case is:

Last six months of paychecks of whole household plus the month of filing. (If filing in October then you need April 1- present) You need these for the Means Test. You will also use these to report income to date for the calendar year. It will also help you identify any garnishments from either creditors or child support.

Last six months of bank statements of ALL financial accounts plus the month of filing. This includes Paypal, CashApp, etc. This will help develop the living expenses section. It can also help identify weird banking activity that a trustee might later figure out is a 547/548 issue. It will also help spot unreported income that may mess with your means testing.

Last two years of tax returns. If client doesn’t have them then they need to go to IRS.gov and order transcripts. You need this information for the Statement of Financial Affairs. It also helps to identify activity that might need to be explained and you want to find it and get the answer before filing a case and a trustee does… like a big retirement withdrawal.

Credit Report pulled within a month of the filing date. There is a service that’s available through the Bankruptcy Software Providers, but one the client pulls is better than nothing. The software provided ones often have the creditor’s bankruptcy department addresses, which can be helpful. This tool is another layer to make sure creditors are included and the balances listed as owed are as recent as can be. They will also help verify whether the debt is joint or individual, which sometimes can matter.

Completed client questionnaire regarding Assets, Liabilities, Income and living expenses. You need this information for many reasons. You just do.

Anatomy of Bankruptcy Petition

Voluntary Petition- Debtor information and statistics from the schedules

Schedules A/B- Disclosure of all real and personal property interests

Schedule C- Application of available exemptions to asset values

Schedule D- Listing of all secured creditors and the related property

Schedules E/F- Listing of all Priority and Unsecured Debt

Schedules G- Disclosure of Executory Contracts and Unexpired Leases

Schedule H- Disclosure of CoDebtors

Schedule I- Disclosure of all Income Sources

Schedule J- Disclosure of Living Expenses

Statement of Intention- Debtor Declaration of intended treatment of Secured Debt & Unexpired Leases

Statement of Financial Affairs- 28 questions about recent financial activity

Statement About Social Security Numbers- Only place the full social is disclosed and is redacted from view by the court clerk.

Means Test- Evaluation of Debtor’s last six months of income

Verification of Matrix- Certification that the Mailing List for creditors is correct

Attorney Compensation Disclosure- Attorney must disclose what they have been or will be paid